Table of Contents

Regarding property matters, “Can you foreclose on life estate?” can be complex and puzzling. Often used in estate planning, life estates grant unique rights to the life estate holder and remainderman. If you’re wondering whether foreclosure can occur on such an arrangement, you’re in the right place. Let’s explore this issue and its relationship with deeds instead of foreclosure, mortgages, and other essential terms. We’ll break down the crucial details of life estates and how foreclosure applies.

What Exactly Is a Life Estate?

Before answering the question, “Can you foreclose on life estate?” it’s essential to understand the structure of a life estate. In simple terms, a life estate is a form of actual property ownership where one person, the life estate holder, has the right to live in or use the home during their lifetime. However, they do not have a total ownership interest. When the life estate holder dies, the property transfers to the remainderman, who then gains full ownership rights.

For example, if a parent sets up a life estate for their home, they can live in the property for the rest of their life. Upon their passing, the property automatically goes to the child (the remainderman) without needing probate. However, this comes with complications, especially in debt and foreclosure cases.

Also Read: Can You File Bankruptcy and Keep Your Home? Discover the Secret!

Can You Foreclose on a Life Estate?

Now, the big question: Can you foreclose on life estate? The answer is yes, but it’s more complex than foreclosing on traditional property ownership. The life estate holder may still face possible foreclosure if they default on debts related to the mortgaged property, but the foreclosure will only impact their rights during their lifetime.

If the life estate holder takes out a loan or fails to pay taxes or other financial obligations like a home equity line of credit, creditors may start foreclosure proceedings. However, this foreclosure typically impacts only the life estate holder’s rights and does not affect the remainderman’s future rights.

How Does Foreclosure Affect Life Estates?

To answer the question, “Can you foreclose on life estate?” let’s explore the implications of foreclosure for both the life estate holder and the remainderman.

- Foreclosure on the Life Tenant’s Interest: If the life estate holder incurs debt, such as a mortgage debt or home equity line, and defaults, creditors can initiate foreclosure proceedings on their interest in the property. However, this foreclosure process impacts only the life estate holder’s ownership interest during their lifetime, and once they pass away, the property still transfers to the remainderman.

- The Remainderman’s Role in Foreclosure: The remainderman is typically unaffected by foreclosure unless they are financially tied to the debt, such as through a mortgage or loan co-signing agreement. If not, the remainderman’s equity and future rights remain intact even if foreclosure occurs during the life estate holder’s lifetime. In most cases, foreclosing doesn’t directly impact the remainderman’s future ownership interest.

Can you foreclose on life estate and affect the remainderman? No, the remainderman’s rights become fully effective only after the life estate holder dies. If foreclosure happens, it’s limited to the life estate holder’s rights during their lifetime.

Also Read: Dominican Republic Flag: Uncover Its Stunning Symbolism

Foreclosure on Mortgaged Property

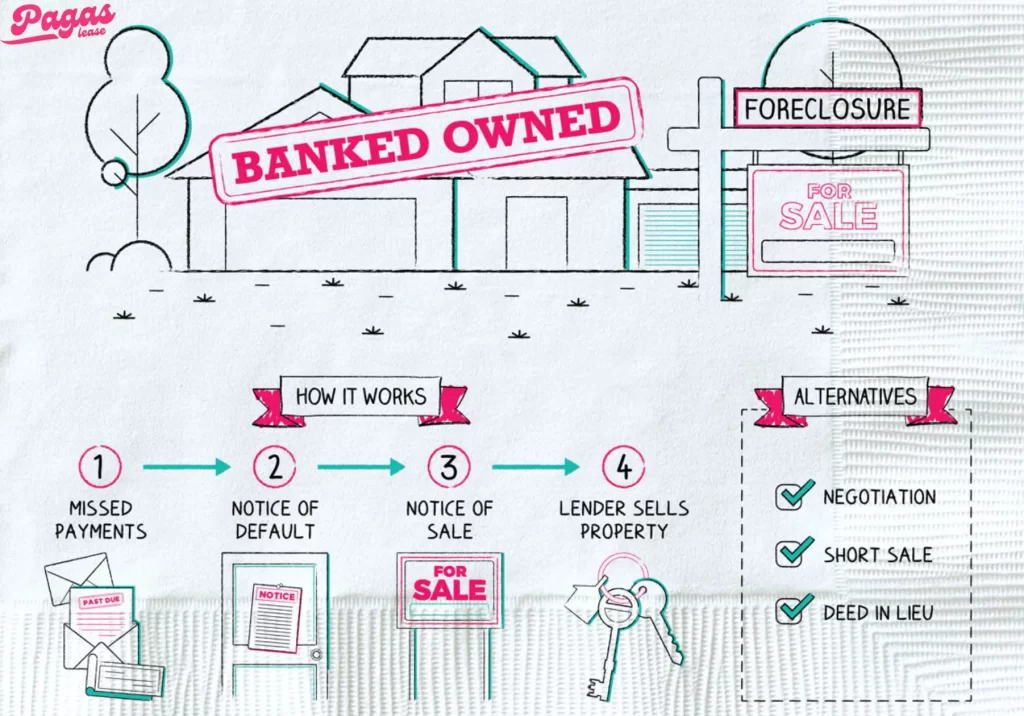

When a foreclosure occurs on mortgaged property, it can be a complicated process. Here’s how it typically unfolds:

- Debt Accrues: The life estate holder takes on debt related to the mortgaged property—this could be a loan or unpaid property taxes.

- Foreclosure Proceedings Begin: If the debtor fails to make payments, creditors or the mortgage holder may file for foreclosure lawsuits or initiate the foreclosure sale process to take possession of the life estate holder’s interest in the property.

- Life Estate Holder’s Interest is Foreclosed: If the foreclosure succeeds, the life estate holder loses their right to live in or use the property. However, the lender’s expensive foreclosure process applies only to the life estate holder’s rights during their lifetime, not to the remainderman’s future interest.

- Remainderman’s Rights Stay Protected: Once the life estate holder passes away, the remainderman inherits the property, assuming no other complications arise. The foreclosure sale price doesn’t directly impact the remainderman’s ownership, as their rights become fully effective after the life estate holder’s death.

Can You Use a Deed instead of Foreclosure?

Another critical option to explore when wondering, “Can you foreclose on life estate?” is the deed instead of foreclosure. This process allows the life estate holder to avoid foreclosure by voluntarily transferring the property to the lender instead of going through foreclosure lawsuits.

A deed instead of foreclosure offers several benefits:

- It allows the life estate holder to avoid the adverse effects of foreclosure on their credit.

- It speeds up the transfer process compared to traditional foreclosure, benefiting the debtor and lender.

- It protects the remainderman’s future rights by resolving the life estate holder’s financial obligations early.

However, a deed in lieu must be agreed upon by the lender, and it may not always be a viable solution if the loan amount exceeds the property’s value. If approved, the deed in lieu could prevent foreclosure and help settle the mortgaged debts.

How to Prevent Foreclosure on a Life Estate

Can you foreclose on life estate? Yes, but it can be avoided. Here are strategies to prevent foreclosing on a life estate:

- Stay Current on Payments: Ensure that all mortgaged property payments are up-to-date, including mortgage debt, property taxes, and home equity obligations. Avoiding debt accumulation can help prevent foreclosure lawsuits.

- Seek Legal or Financial Help Early: If facing financial difficulties, the life estate holder should consult a lawyer or financial advisor to discuss options like injunction or deed instead of foreclosure. Early action can prevent foreclosure altogether.

- Refinance the Mortgage: Refinancing can lower the monthly loan payments, making it easier to manage debt and avoid foreclosure lawsuits.

- Consider a Deed in Lieu: A deed instead of foreclosure may help the life estate holder avoid a complete foreclosure process, protecting their rights and the remainderman’s future interests.

- Create a Clear Estate Plan: Thoroughly plan out the life estate arrangement, ensuring the property is free of debt before the life estate is established. This can minimize the risk of future foreclosure.

Also Read: Can You Foreclose on Life Estate? Critical Facts You Missed

Key Takeaways: Can You Foreclose on Life Estate?

To conclude, can you foreclose on life estate? Yes, but it’s important to remember that the foreclosure affects only the life estate holder’s interest during their lifetime. The remainderman’s future rights generally remain intact, meaning they will still inherit the property once the life estate holder dies.

A deed instead of foreclosure, refinancing options, and other legal actions can help prevent foreclosure. Still, it’s crucial to understand how foreclosure sales, mortgaged property, and other elements work within the structure of life estates.